ACCA Syllabus

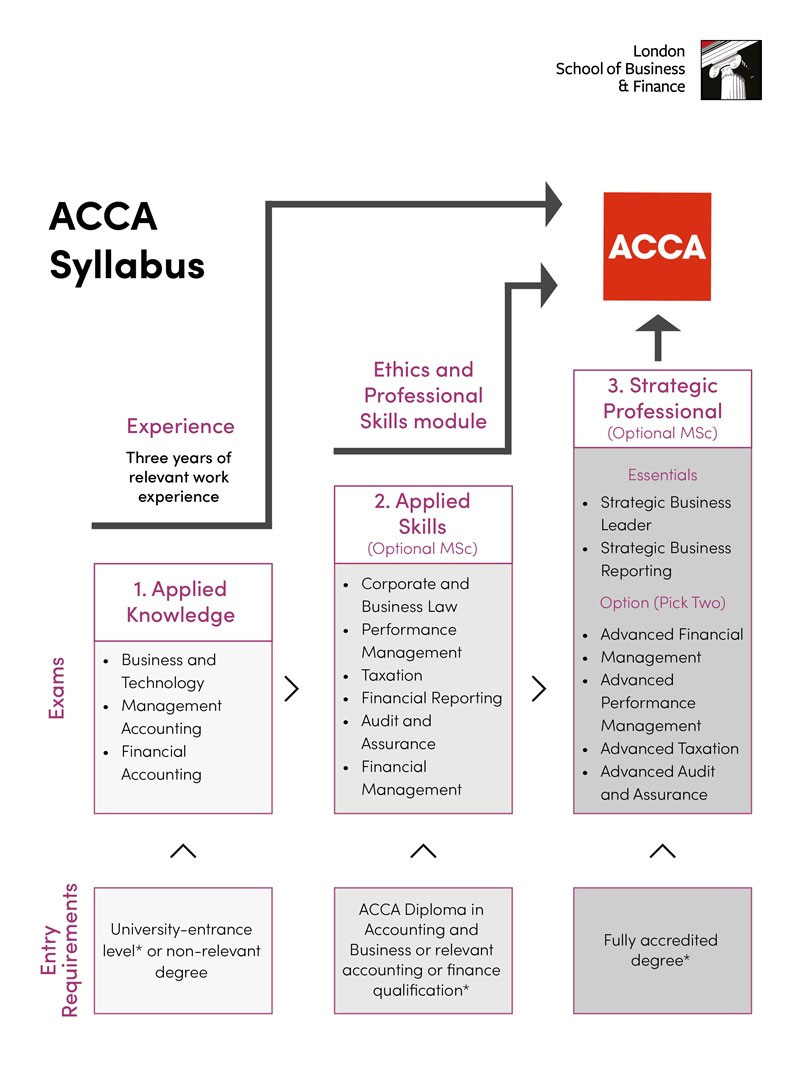

The ACCA (Association of Chartered Certified Accountants) syllabus has three stages.

Here is a breakdown of the stages and the ACCA exam list:

1- The Applied knowledge stage contains three exams: Business and Technology (BT), Management Accounting (MA) and, Financial Accounting (FA).

2- The Applied Skills stage contains six exams: Corporate and Business Law (LW), Performance Management (PM), Taxation (TX), Financial Reporting (FR), Audit and Assurance (AA) and, Financial Management (FM).

3- The Strategic Professional stage contains six exams divided into two Essentials exams: Strategic Business Leader (SBL) and Strategic Business Reporting (SBR), and four Options exams: Advanced Financial Management (AFM), Advanced Performance Management (APM), Advanced Taxation (ATX) and Advanced Audit and Assurance (AAA).

Students must also complete the ACCA Ethics and Professional Skills stage. Depending on your current qualifications, you may be exempt from some of the 13 ACCA exams.

You can find out more information below:

The ACCA course syllabus consists of 13 exams divided into three levels:

- Applied Knowledge - 3 exams

- Applied Skills – 6 exams

- Strategic Professional – 2 Essentials exams and 2 Options exams out of 4

ACCA Levels Explained

Applied Knowledge

This stage, which includes BT, MA and FA exams, is the starting point for achieving your ACCA certification. Once you've passed all three exams, you can continue to the next stage of the ACCA qualification: Applied Skills.

Applied Skills

The applied skills stage examines the core technical ACCA subjects including law, taxation, auditing and financial management, financial reporting and performance management. You will develop knowledge and skills in these subject areas, reaching a level of knowledge equivalent to a bachelor's degree.

Strategic Professional (Essentials)

This stage is called Essentials, as it will provide you with the specialised skills and techniques required to become an expert accountant, either in a consultancy or high-level advisory role. Both ACCA exams are three hours long.

Strategic Professional (Options)

Students choose two from the four Options exams.

Minimum entry requirements:

- Two A-Levels and three GCSEs or equivalent in five subjects, including English and Mathematics

- Good level of English proficiency

Foundations in Accountancy route (FIA)

- Must be 18 or over

- Students who complete the Diploma in Accounting and Business via Foundations in Accountancy can transfer to the ACCA Qualification and commence their studies from LW onwards

- Gain exemptions from BT, MA and FA ACCA exams

Graduate entry route

- Relevant degree holders from ACCA-accredited institutions may be exempt* from up to nine exams within the Applied Knowledge and Applied Skills levels and register directly at the Professional level

- Holders of recognised business and/or accounting degrees may also qualify for exemptions*

*We advise you to check your starting point with ACCA before enrolling on the course.

*Please see full Terms and Conditions for more information.

*Please see full Privacy Policy for more information.

Information about ACCA degree technical requirements

Our platform does not require any additional software. However, it is advisable that students install Microsoft Office on their computers as tutors may provide additional downloadable notes in Doc, Xlsx, PPT and PDF formats.

Google Chrome, Firefox, Microsoft Edge, and Safari (Macintosh only) are all supported by Canvas.

Canvas has been carefully crafted to accommodate low-bandwidth environments. A minimum internet speed of 512kbps is recommended.

Information about when access to materials opens and closes during ACCA Courses

Access to all learning materials and live sessions opens in the month of intake and closes three months later. For example, if teaching starts in mid-June, access will stop in mid-September after the exams . Students taking Computer-Based Assessments (CBE) have access for six months.

Learning materials consist of the following:

- Live tuition and revision sessions

- Recorded live tuition and revision sessions

- Study manuals, question banks, class, and revision notes

- Other relevant materials tutors may provide

Available resources for enrolled students before live tuition begins:

- Access to recorded live tuition and revision for the session that is currently running

- Access to study manuals, question banks, class and revision notes

Students who have purchased a ACCA course but have not yet enrolled can request access to study manuals and / or question banks to begin with ACCA preparation.

Timetable

All ACCA courses are taught in the evening (UK time), Monday to Thursday. Classes typically start at 6:30 PM and end at 8:30 PM, and revision ends at 9 PM.

We also provide a mentoring hour in the evenings for all students. During mentoring hours, tutors mark students' homework and speak to students directly about any concerns.

Usually, there are eight weeks of live online tuition (Some courses have up to two extra sessions) and four weeks of live online revision.

For Computer-Based Examinations (CBE):

- Business Technology – 8 weeks

- Corporate and Business Law – 10 weeks

- Management Accounting – 11 weeks

- Financial Accounting – 12 weeks

Face-to-face revision is offered on two weekends in London. Students can either join the session live online or watch the recording if they cannot attend.

Learning Expectations

We recommend that students allocate nine hours of self-study per week in addition to live classes. For the Strategic Professional exam, we advise 12 hours of self-study.

You will be asked to complete homework in every tuition and revision session, which will be marked with feedback provided during your mentoring hour. You will also be asked to complete a time-limited exam in line with the ACCA papers list.

We expect students to attend all live sessions, but if that is not possible (e.g. time zone constraints), we ask that students utilise the recorded sessions. If you do not attend any live or recorded sessions, you may be removed from the course and deferred to the next session.

Information about Practical Experience Requirement (PER)

To become fully qualified accountants, students must gain practical experience during an ACCA programme.

Students must take the Ethical and Professional Skills module and gain professional experience by spending 36 months in an accounting or finance-related role.

Exam success, practical experience, and knowledge of ethics enable you to become a successful accountant.

More detailed information can be found at PER-trainee-guide.pdf (accaglobal.com)

Topics that you will cover in your course

| S.No. | ACCA Paper | Topics | Tutor |

| 1 | Corporate & Business Law | Unit 1 --The English Legal System Unit 2 -- Contract – formation Unit 3 -- Contract – terms, breach Unit 4 -- Tort, Employment, Introduction to Agency & Partnership. Unit 5 -- Partnership Unit 6 -- Company Law (legal personality & company formation, Share capital, Loan capital, Meetings & resolution) Unit 7 -- Company Law (Directors, Meetings & resolutions, other officers, Insolvency) Unit 8 -- Fraudulent behaviour |

Debbie Crossman |

| 2 | Business & Technology | Unit 1 -- Training and development Unit 2 -- Personal effectiveness. Performance appraisal Unit 3 -- Leading People. Individuals and teams Unit 4 -- Motivation. The role of accounting. Micro-economics. Unit 5 -- Macro-economics. Business environment. Business organisation. Unit 6 -- Organisational culture. Corporate governance. Ethics. Unit 7 -- Information systems. Control and security. Fraud. Unit 8 -- Revision (working through BT CBE) |

|

| 3 | Financial Accounting | Unit 1 --Introduction to Accounting and Double Entry Unit 2 -- Adjustments to Financial Statements Unit 3 --Non-current Assets Unit 4-- Accurals and Prepayments Unit 5 -- Maintaining records for Customers and Suppliers Unit 6 -- The Correction of Errors and Bank Reconciliation Statements Unit 7 -- Process of Accounting for Limited Companies Unit 8 -- Accounting Standards Unit 9 -- Cash Flow Statements Unit 10 -- Interpretation of Accounts Unit 11 -- Introduction to Group Accounting |

|

| 4 | Performance Management | Unit 1 -- Overview of information systems. Costing methods. Unit 2 -- Costing methods. Unit 3 -- Short-term decision making (many topics fall under this heading: relevant costing, further processing, make or buy decision, limiting factor analysis, linear programming) Unit 4 -- Short-term decision making (CVP analysis). Pricing. Unit 5 -- Decisions under uncertainty. Budgeting. Unit 6 -- Budgeting (learning curves). Advanced variances Unit 7 -- Financial and non-financial performance evaluation. Unit 8 -- Divisional performance and transfer pricing. |

|

| 5 | Taxation | Unit 1 -- Fundamentals of taxation and the basics of corporation tax Unit 2 -- Corporation tax, treatment of a company's loss and Groups Unit 3 -- Personal tax computation, Employment Income and NICs Unit 4 -- Trading profits, the basis of assessment and Partnerships Unit 5 -- Fundamental of chargeable gains Unit 6 -- Chargeable gains: partial disposals, reliefs and exemptions Unit 7 -- Fundamental of inheritance tax and lifetime transfers Unit 8 -- Inheritance tax: death estate and VAT |

Barbara Begio |

| 6 | Financial Reporting | Unit 1 -- Consolidated Statement of Financial Position Unit 2 -- Consolidated Statement of Financial Position, Consolidated Statement of Profit or Loss, and Associates Unit 3 -- Practice Questions Unit 4 -- Published Accounts – Introduction, and Non-current Assets Unit 5 --Impairment of assets and Leasing Unit 6 -- Revenue, Contracts and Assets held for sale Unit 7 -- Taxation adjustments and Provisions & Contingencies Unit 8 -- Financial Instruments Unit 9 -- Earnings Per Share; Analysis and Interpretation |

|

| 7 | Audit & Assurance | Unit 1 -- Essential Exam Technique for the AA paper Unit 2 -- Key Audit Concepts Including Ethics Unit 3 -- Audit Planning including Risk Unit 4 -- Internal Controls in Audit Unit 5 -- Audit Evidence Principles Unit 6 -- Substantive Procedures Unit 7 -- Finalisation of the Audit and Audit Report Unit 8 -- Internal Audit |

|

| 8 | Financial Management | Unit 1 -- Introduction to Financial Management & Investment Appraisal Techniques Unit 2 -- Advanced Investment Appraisal Unit 3 -- Advanced Investment Appraisal Unit 4 -- Sources of Finance and Cost of Capital Unit 5 -- Unit Structure and Financial Performance Unit 6 -- Raising Equity Finance and Financial Performance Measures Unit 7 -- Risk Unit 8 -- Working Capital Management |

|

| 9 | Strategic Business Leader | Unit 1 -- Strategic Analysis Unit 2 -- Strategic Choice Unit 3 -- Values, Ethics and Professional Skills Unit 4-- Corporate Governance and Stakeholders Unit 5 -- Risk Unit 6 -- Using Numbers – investment appraisal, Ratio Analysis, Decision making and Forecasting Unit 7 -- Operational Improvement Unit 8 -- Project Management |

David Laws |

| 10 | Strategic Business Reporting | Unit 1 -- Basic Groups Unit 2 -- Changes In Group Ownership Unit 3 -- Foreign Currency Translation and Group Cash Flow Statements Unit 4-- Performance Reporting Unit 5 -- Provisions and Non-Current Assets Unit 6 -- Leases and Employee Benefits and Share-Based Payments Unit 7 -- Financial Instruments Unit 8 -- Tax and Other Corporate Reporting |

|

| 11 | Advanced Financial Management | Unit 1 -- Senior Financial Manager & Advanced Investment Appraisal Unit 2 -- Advanced Investment Appraisal & Introduction to Options Unit 3 -- Real Options, Project Specific & Combined Asset Beta WACC’s Unit 4 -- Adjusted Present Value & International Investment Appraisal Unit 5 -- Mergers & Acquisitions and Valuation Techniques Unit 6 -- Framework for M&A / Reconstructions Unit 7 -- Hedging Foreign Exchange Risk Unit 8 -- Hedging Interest Rate Risk |

David Laws |

| 12 | Advanced Performance Management | Unit 1 -- What is Strategic Control? Unit 2 -- Management Control Unit 3 -- Organisation Structure Unit 4-- Financial Performance Unit 5 -- Divisionalisation Unit 6 -- Non Financial Performance Evaluation Unit 7 -- Issues with Performance Systems Unit 8 -- Employability and Technology Skills |

Jean-Paul |

| 13 | Advanced Taxation | Unit 1 -- Introduction to Corporation Tax Unit 2 -- Corporation Tax groups & Losses Unit 3 -- Fundamentals of Inheritance Tax Unit 4-- Valuation rules for Inheritance tax & the Death Estate Unit 5 -- Fundamentals of Taxing Capital Gains Unit 6 -- Capital Gains Reliefs and Exemptions Unit 7 -- Personal Tax Computations and Investment Advice Unit 8 -- Income from Employment and Self-employment Unit 9 -- Trading Losses and Partnership |

Zahid Ahmed |

| 14 | Advanced Audit & Assurance | Unit 1 -- Essential Exam Technique for the AAA paper Unit 2 -- Ethics and Professional Issues Unit 3 -- Practice Management including Quality Management of audit work Unit 4 -- Audit Planning, including Risk Unit 5 -- Audit Procedures and Evidence Unit 6 -- Finalisation of an audit plus Group Audit Considerations Unit 7 -- Audit Reports Unit 8 -- Other Assignments and Current Audit Issues |

|

| 15 | Management Accounting | Unit 1 -- Introduction to Cost Accounting; Cost Classification and Behaviour Unit 2 – Materials, labour and Overheads Unit 3 -- Overheads and Absorption Costing and Cost bookkeeping Unit 4-- Absorption vs Marginal Costing. Job Costing Unit 5 -- Job, Batch and Service Costing (continued). Process Costing Unit 6 -- Budgeting and Introduction to Statistical Techniques Unit 7 -- Advanced Statistical Techniques Unit 8 -- Investment Appraisal Unit 9 -- Standard Costing and Variance Analysis Unit 10 --Performance Measurement (Financial Performance) Unit 11 -- Revision |

- Maximum of two exams to be taken in one sitting

- Exams within a module may be taken in any order, but ACCA recommends that they should be taken in numerical order

- Exams must be taken in modular order for the ACCA Qualification. If you wish to sit exams in the next module, you must also enter all outstanding exams in your current module

- The two Essentials ACCA exams do not have to be sat together

- Students have 10 years to pass all the examinations on the ACCA exams list. They have seven years to pass the exams at the Professional level (SBL and SBR and two options exams AFM - AAA). The seven-year time limit starts when a student passes their first Professional-level exam

- The pass mark for all examinations is 50%

- In addition to the 13 ACCA exams, students must study an online module in Professional Ethics. It is recommended that this is studied at the same time as SBL

- Practical experience required

Request More Information

Message us on WhatsApp or contact a programme advisor by phone:

+44 (0) 20 3005 6336

Student comments

Maruf Aripdjanov

Sriya Chauhan

Anandi Deonarin