Accountancy careers in sports: mixing fun with success!

- 25th July 2014

- Written by LSBF Staff

- Opinion & Features

Accounting is a profession that can lead to all kinds of opportunities. But did you know it could be your ticket into the sports industry?

When you think of accountancy, chances are that finance springs to mind. Of course, that’s the bread and butter of what accountants do – making sure that businesses and individuals can handle their income legally and effectively.

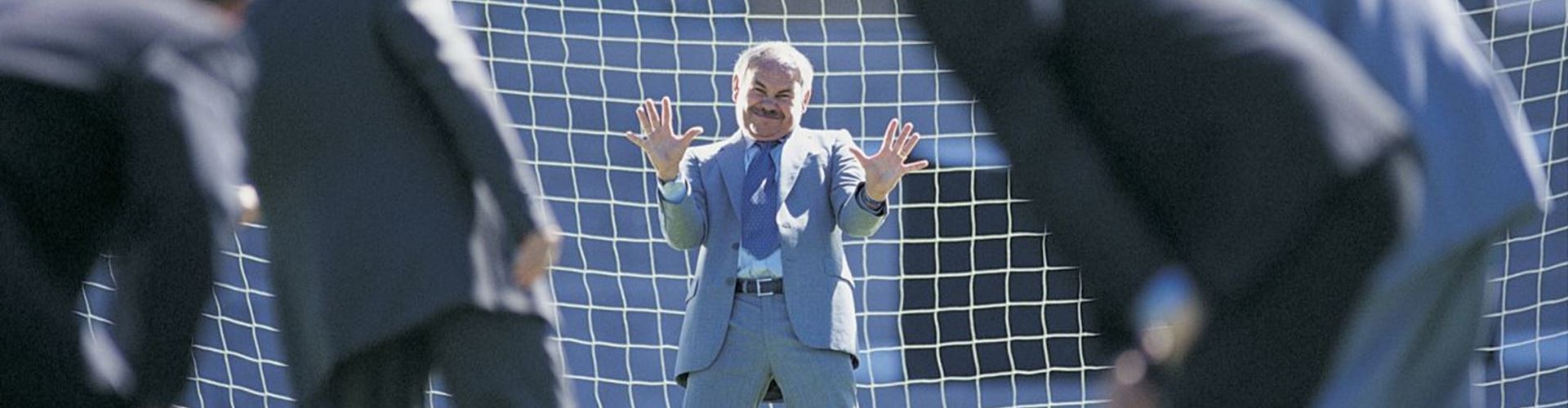

But becoming an accountant does not have to literally mean working in the financial services industry. Every business needs a good accountant, and that could mean working in any number of sectors. If you’ve ever dreamed of scoring the winning goal in the World Cup Final, you might even consider becoming an accountant in sport.

What’s the job?

The beauty of a qualification in accountancy is that every business – including a sports-related company such as a football club or even a sports centre – ultimately needs to achieve the same thing. Quite simply, they need to make sure that their income and outgoings balance so they can continue to survive.

As a result, working as a sports accountant involves many of the same day-to-day tasks as any other accounting role. But finance professionals in the sports sector also have special issues to deal with, including special revenue and expenses items. Obviously, high player salaries are a key consideration, while income comes from a huge variety of sources, such as advertising deals, merchandise and ticket sales.

Where could you work?

Many specialist sports accountants work in the finance departments of major sports companies. That could mean a football or tennis club, an event promoter who specialises in marketing sporting events, or even for an agent or management company that represents sporting talent.

But you don’t necessarily have to work in-house – it’s equally possible to work in any one of the number of firms that offer specialist accountancy services for professional sportspeople and companies, or even as a freelancer. And you could even work for individual sportspeople, since many have high incomes and some are treated as self-employed. If you’re more interested in working for individuals than companies, it might make sense to join or set up a firm.

What’s in it for you?

Obviously every employer is different, but if you work in-house there’s a strong chance of getting discounted or even free entry to big-ticket sporting events. If you’re a major fan, the potential to have close contact with the occasional player might even help to persuade you.

One thing we do know is that in a world with sky-high player salaries, advertising deals, stadium deals and licensing fees, accountants have a lot of responsibility. As a result, accountants’ salaries can also reach great heights.

Chron.com notes that labour statistics from as far back as 2011 put the average pay of an accountant in spectator sports at $68,070!

However, it’s important to note that depending on your experience and the size of the team you’re working for, that figure could be considerably more.

Fancy a glamorous career in sports accountancy? Begin your journey to success with a CIMA at LSBF!

Other Opinions and Features

The Rise of Mobile Accounting

Accounting has always been a field that’s associated with piles of paperwork, spreadsheet and staggering numbers. Using computers to carry…

What will the role of the CFO look like in the future?

The CFO role is often thought of as being largely preoccupied with numbers and data, but in the last few…

7 Myths About Accountancy

Wondering what accountancy is really like as a career? Many people think that being an accountant is just number crunching…