An Introduction to Private Equity, Mergers and Acquisitions

- 29th October 2018

- Written by LSBF Staff

- Accountancy & Finance

You might have come across the terms private equity, mergers, and acquisitions. These terms are usually categorised under the vast umbrella of investment capital, but what do they really mean and why are they considered important in today’s time? Read on to find out.

What is private equity?

Private equity (PE) has gained lots of momentum over the last few years. It refers to the shares of an organisation that are not openly listed or traded. In a nutshell, private equity is capital that is not listed on a public stock exchange and is a source of investment capital. The private equity industry mainly consists of institutional investors and large equity firms. These two groups have the power to dedicate huge amounts of money for a long period of time. Occasionally, these firms may create pools of private equity funds for the sole purpose of privatising large organisations, which is known as leveraged buyouts. Once this is complete, these firms try to improve the overall financial prospects of the organisation with the eventual goal of reselling the organisation or introducing an initial public offering.

There are various types of private equity, including:

- Venture capital: This type of private equity focuses on start-ups that have great financial potential. The investment is usually done in the initial stages of the start-up to obtain high returns in the future vis-à-vis low investment. Someone who invests in these start-ups is known as a venture capitalist.

- Growth capital: This form of private equity investment is usually done in stable organisations that are in expansion mode. The expansion could be into a new market, to develop new products or for funding acquisitions.

- Mezzanine financing: This refers to investing in the debt of an organisation. If this debt is not cleared or paid back in time, the PE investors have the opportunity to convert this debt into equity interest. Mezzanine financing has a high rate of interest, making it a lucrative option for PE investors.

- Real estate: Real estate refers to equity investment that specialises in purchasing real estate properties. This investment is done using several strategies, such as:

- Core: In this case, the investments are made in properties that provide regular cash flow.

- Core plus: Investments are made in properties that involve a modicum of risk, and where improvements have to be made to the properties.

- Value-add: Investments are made in properties that require good amount of improvements, hence these properties have high risk.

What do private equity firms do?

Private equity companies usually perform several tasks in order to earn money, such as:

- Raise money from Limited Partners (LPs) such as endowments, insurance firms, wealthy individuals, and retirement and pension funds;

- Conduct equity research, examine, approve and close deals to acquire firms;

- Improve operations, reduce costs and increase managerial efficiency in their portfolio companies;

- Sell their portfolio companies in order to earn profits.

Why should you choose a career in private equity?

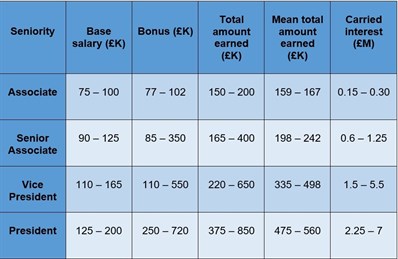

Careers in private equity are demanding and include long hours, though the work is interesting. If you are working in private equity, you will get opportunities to interact with CEOs and managers of top organisations. Excluding the basic salary and bonus, PE professionals receive a ‘carried interest’ incentive. This interest is a direct share in the PE firm’s profits and a part of its earnings. Take a look at the following table as it shows the average salaries earned in private equity firms in the UK according to seniority (source: Kea Consultants).

If you are interested in working for top private equity firms, it is recommended that you have a professional background in strategy consulting, investment banking and corporate development. In addition, you should possess skills such as:

- Ability to create and assess financial statements and spreadsheets;

- Knowledge of specific industries;

- Financial modelling;

- Business insight;

- Market and competitor analysis.

What are mergers and acquisitions?

Mergers and acquisitions (M&A) are defined as a consolidation of corporations done through a variety of financial transactions. A merger is the combination of two firms to form one, and an acquisition is when one firm takes over another. M&A usually take place when:

- Assets are purchased;

- Common shares are purchased;

- Assets are exchanged for shares;

- Shares are exchanged for assets.

There are a few steps involved in any merger and acquisition:

- Step 1- Pre-acquisition assessment: This includes a self-assessment of the acquiring company with respect to the M&A requirements.

- Step 2- Search and examine candidates: This involves searching for quality companies for takeover purposes.

- Step 3- Investigate the candidates: Once the target company is chosen, an in-depth analysis of the company has to be conducted, along with assessing the company valuation. This is also known as due diligence.

- Step 4- Acquire the company through negotiations: Once the due diligence is complete, negotiations for a merger or acquisition begin.

- Step 5- Post-integration: If the above steps fall into place, there is a formal announcement of the merger or acquisition.

There are several reasons why mergers and acquisitions take place, such as:

- Improving company performance and increasing growth;

- Diversification into new products and markets;

- Tax considerations;

- Diversification of risk;

- Increasing market share.

What are the differences between mergers and acquisitions?

Take a look at some of the differences between mergers and acquisitions:

- In a merger, the two firms dissolve to form a new firm, while in an acquisition the two firms do not have to be dissolved and can stay in business.

- A merger usually occurs between two organisations of the same stature, whereas in an acquisition, a larger company purchases and takes control over a small company.

- There are a minimum of three firms involved in a merger, while there are only two in an acquisition.

- A merger only takes place when both organisations voluntarily agree to it. On the other hand, an acquisition can be either voluntary or involuntary in nature.

- There are more legal formalities in a merger than in an acquisition.

What are the pros and cons of mergers and acquisitions?

Here are some of the pros of M&As:

- It adds more value to the combined firm than to each individual firm.

- It helps access new markets for both firms.

- It is a cost-effective method for expansion purposes.

- It leads to several growth opportunities.

- It helps reduce the overall risk.

- Economies of scale (which refer to a reduction in cost per unit due to increase in total output of a product) are formed by combining the services and resources of the two companies.

And here are some of the cons of M&As:

- It leads to distress, uncertainty and confusion among the employees of both organisations.

- It may lead to an increase in overall debt.

- There may be differences in the culture of both organisations.

- It may lead to an increase in operational costs.

If you are interested in pursuing a career in private equity and mergers and acquisitions, you can enrol for specialised courses offered by London School of Business and Finance offers, such as Postgraduate Certificate in Mergers and Acquisitions and Online MA in Finance and Investment (Mergers, Acquisitions and Private Equity).

This article was written by Varun Mehta and edited by Luna Campos.

Other News

13 ACCA Papers & Exemptions: Complete Student Guide

The Association of Chartered Certified Accountants (ACCA) is one of the most prestigious, globally-recognised certifications for professionals wishing to develop…

How ChatGPT Helps ACCA Students in Acca Exams Preparation?

Here, we will discuss how to use ChatGPT to supplement your ACCA studies and exam performance, but we will also…

Is A Master Of Science In Finance Worth It?

A Master of Science in Finance is a specialised postgraduate programme to advance your knowledge and practical skills in economics,…