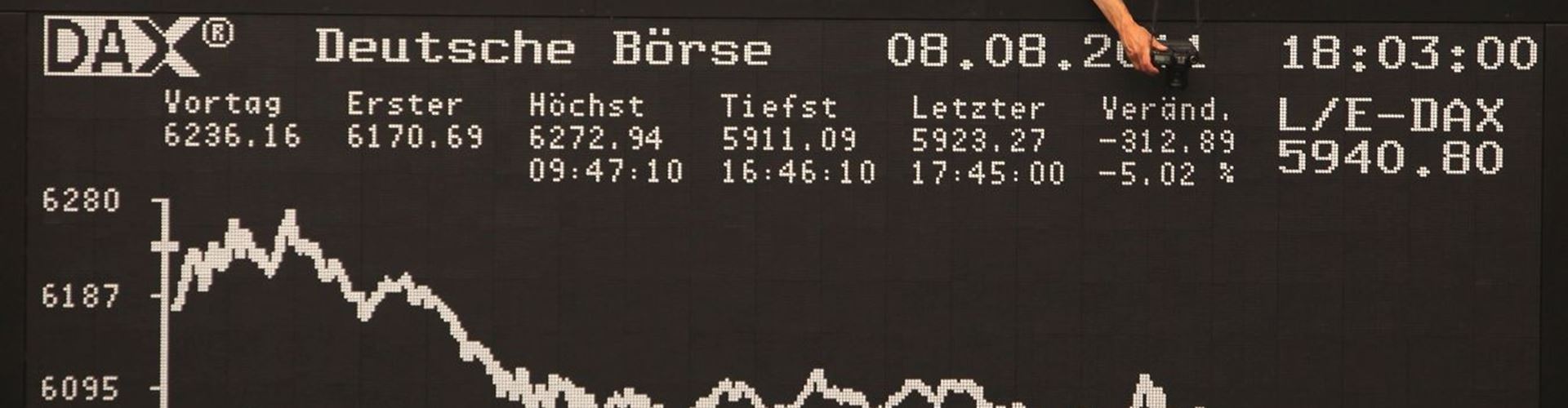

IPOs in European stock markets begin to lose steam

- 3rd July 2014

- Accountancy & Finance

A flurry of high-value IPOs have kept Europe’s markets busy recently, but it seems interest is cooling off.

European markets have seen a rush of high-value initial public offerings (IPOs) in the past few months. London alone has been a hive of flotation activity, but Paris and Frankfurt have also been attractive locations.

On 3 July, ING floated its insurance arm NN Group on the Amsterdam stock exchange in the largest IPO of the year, which valued the company at €7 billion.

But a new report from Bloomberg suggests that investors are becoming more wary about which prospects they should back.

After all, at least eight companies including retailer Fat Face and Hungarian budget airline Wizz Air withdrew their plans to float over the same period, complaining of difficult market conditions.

It comes even as the past three months have seen firms raise more capital than in any quarter since 2006, with 113 IPOs raising a total of around $31 billion “in markets from France to Spain” – a marked difference from $17 billion in the previous quarter. But with the average share price gaining just two per cent across its first day of trading, not all of them have lived up to expectations.

Though some companies have sought to allay these concerns by pricing shares at the lower end of the spectrum, even that hasn’t always proved successful, Bloomberg says, pointing out that Euronext NV did exactly that and has still seen shares fall by nearly six per cent since its IPO last month.

But Quentin Webb writes in a column for Reuters that London is the real drag on performance across Europe – big flops such as Pets, AO and Just Eat have contributed, but six of the UK’s ten biggest IPOs so far this year are below their offer price.

Even so, with companies such as discount retailer B&M planning to float and Lloyds still to sell off the rest of its stake in TSB, there will be plenty of interesting share offers for investors to look at. It may just be they become more selective.

Other News

The Importance of Financial Management

Financial management is one of the most important aspects in business. In order to start up or even run a…

ACCA and CIPM of Nigeria sign a collaborative agreement

According to a recent article by The Guardian earlier this month, the Association of Chartered Certified Accountants (ACCA) and the…

AAT achieve KHDA recognition

We are excited to announce that AAT has been officially recognised as an International Certification Organisation by the Knowledge and…