Online Master in Finance and Investments - Specialisations

Secure a rewarding career in financial management with this comprehensive online Master, delivered 100% online. You will cover both advanced financial theory and vital professional skills, in the context of the modern business environment.

Key Facts

Duration: 18-36 Months (100% Online)

Start Dates: January, April, July, October.

Campus: Online

Fees: £8000 (Student Payment Plan available)

Risk Management

Duration: Online 18-36 months

Start Dates: January, April, July, October

Accounting and Financial Management

Duration: Online 18-36 months

Start Dates: January, April, July, October

Investment Banking and Capital Markets

Duration: Online 18-36 months

Start Dates: January, April, July, October

Mergers, Acquisitions and Private Equity

Duration: Online 18-36 months

Start Dates: January, April, July, October

**All specialisations are available, subject to student demand.

This Master’s programme is ideal for finance professionals, graduates and those with business experience who wish to take their careers to major international companies. It will equip you with the critical skills you need to perform the strategic tasks required in high-level finance and investment positions.

Regardless of where your interests lie within the field, our Master in Finance and Investments is your ideal stepping-stone to a range of rewarding career opportunities. Upon completion, you will be fully equipped to take your career to the next level.

Our wide range of core and specialist modules will leave you able to act autonomously in planning and implementing global financial strategies. These include Business and Financial Analysis, Quantitative Finance and Financial Markets, as well as Corporate Finance.

The programme also incorporates a number of pathways – Accounting and Financial Management, Investment Banking and Capital Markets, as well as Risk Management and M&A and Private Equity, among others. This means you can tailor the programme structure according to your career goals.

You will participate in lively debates and business related case studies. These take place during lectures and seminars led by our engaging, industry-experienced lecturers. You will also benefit from comprehensive materials, presentations, interactive activities and workshop sessions.

Our student community consists of ambitious people from all corners of the globe, allowing you to gain a truly international learning experience.

The average age range of current students is 26-35 years, with 55% of these students being male and 45% female.

The average years of work experience amounts to 2.5 years (although, please note, that no work experience is required to enter this programme). Our current students come from diverse backgrounds, with experience in accounting and finance, business, science and technology, law, and art.

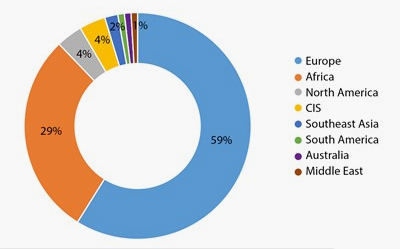

Student nationalities by percentage

From online Master in Finance and Investments students, 2015-2016

Request More Info

Or contact a programme advisor by calling

Student comments

Sami Mathlouthi

Sumit Ahuja