Accountancy & Finance

LSBF News

PSC register implementation coming soon

Preparations now need to be made by accountants and other professionals who may be responsible for maintaining the statutory registers…

European Central Bank keeps interest rates unchanged

The Eurozone's interest rates remain unchanged after the European Central Bank (ECB) decided to keep them at 0.05% at its…

Lending at seven-year high, says Council of Mortgage Lenders

The trade association for mortgage lenders in the UK, the Council of Mortgage Lenders (CML), has reported that annual mortgage…

National insurance contributions allowance reform needed, believes CIOT

The Chartered Institute of Taxation (CIOT) has called for a rethink on the new UK National Insurance contributions (NICs) allowance…

Grant Thornton tops Experian Corpfin league again

The Experian CorpFin league table is a respected metric for the UK accountancy and financial sectors, and this year Grant…

Temporary workers draft legislation and guidance published

Under proposed changes to taxation laws in the UK, from 6th April 2016 certain temporary workers will no longer be…

Benefits of the new Personal Savings Allowance

A new tax exemption on savings income comes into force on 6th April and will bring a range of benefits…

Major new accounting standard – IFRS 16 Leases

A major new accounting standard called IFRS 16 Leases has been issued by the International Accounting Standards Board (IASB). Previous…

Midlands accountancy powerhouse created by merger

Two prominent accountancy firms in the Midlands have merged to create a new firm that is likely to have a…

HMRC issues interim peer-to-peer loans tax rules

HM Revenue & Customs (HMRC) has clarified the tax treatment of interest payments from peer-to-peer (P2P) loans by issuing interim…

R&D tax relief for SMEs goes live

UK small and medium-sized businesses with a turnover of less than £2 million and which employ fewer than 50 people…

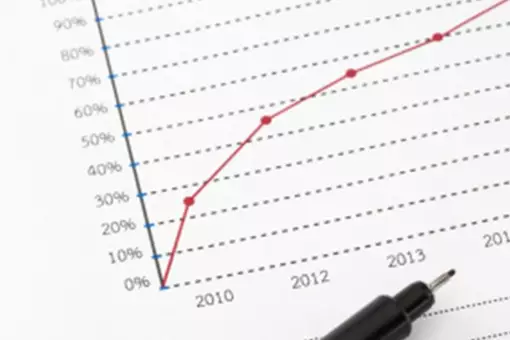

Irish tax revenues exceeded 2015 target

The Irish fiscal deficit has been reduced by €5.2 billion after tax revenues received by the Government were greater than…